Much has been written opining the impact of high-levels of content publishing online across the globe and its impact on marketing. In fact, Mark Schaefer was the first to kick off the debate in January of 2014. To paraphrase his argument: The amount of content being published online is increasing at an exponential rate and will surpass people’s ability to consume it. He calls this “Content Shock.”

Several others, including myself, have weighed in on its impact moving into the future. As time has passed the impact has become clearer and clearer. Many folks have witnessed the impact of content surpluses firsthand through diminishing returns with increased time and resources spent on content and inbound marketing activities.

In large part, this is fueling the incredible growth of both native advertising and influencer marketing. These are paid and earned media channels, respectively, that are generally considered outside the periphery of inbound (owned media). Inbound is considered a pull-type of marketing versus outbound or push-type marketing. The words themselves have opposite meanings.

HubSpot’s Rise to Inbound Greatness

HubSpot gets credit for coining the term and making it virtually a marketing household name over the years. They’ve defined it and created whole processes around it, all while expounding the virtues of what inbound marketing can accomplish. I’ve witnessed firsthand the incredible impact it can have on hundreds of businesses and industries over the years.

It was sometime in 2006 when HubSpot turned its ideas around inbound marketing into software for execution. The timing couldn’t have been better (more on this later). Just a year or so earlier, SEOmoz (just Moz today) was doing its own form of inbound marketing (whether they knew it or not) and having remarkable success.

Inbound marketing propelled HubSpot from a small software startup to a public company in 2014. It has millions of subscribers to its blog and it’s meticulously harvested for leads. Their inbound model has been replicated (or at least attempted) by hundreds of thousands, if not millions, of companies across the globe. This inbound approach to online marketing continues its growth trajectory today.

Can HubSpot Afford to Do Inbound Marketing Anymore?

This question was raised by Louis Gudema in his article titled the same as above. Mark Schaefer later added his thoughts in a write-up he did, too.

Mark does a nice job in summarizing Louis’s article in the below six points. No need to do a separate summary:

- Hubspot’s inbound system is built on the promise of cost-effective customer acquisition. Creating high-potential leads attracted by content should theoretically be less costly than having a team of salespeople pounding the streets.

- However, the company’s public data shows that its sales and marketing costs are extremely high, and getting higher. Some analysts have said these high costs have been a burden that has prevented Hubspot from ever turning a profit.

- In the last two years, Hubspot stopped releasing the cost of customer acquisition information. Using publicly-available data, Louis did his own calculations to estimate that Hubspot’s cost of customer acquisition has increased by 133 percent.

- HubSpot wrote in its 2014 annual report: “We believe that customer acquisition cost, or CAC, is an indicator of the efficiency of our sales and marketing programs in acquiring new customers.” Louis hypothesizes that the company has stopped releasing this cost data because it would be embarrassing to share.

- He adds that Hubspot has built up tremendous SEO equity with its content. The company receives about $5 million of organic search clicks each month, an evergreen asset that will deliver search traffic for a long time.

- However, the search traffic is not necessarily converting into leads or sales. One customer reports that one out of every 400 inbound contacts becomes a lead.

Peter Caputa, former Sales VP at HubSpot and current founder and CEO of Databox, later retorted that HubSpot’s customer lifetime value offset its CAC. This led Louis to add an update to his post:

This confirms my earlier point that if a company’s LTV is high enough — typically more than 3X its CAC for a SaaS company — then it can afford a high CAC. Few companies will be able to grow their LTV fast enough to support such a rapidly rising CAC, though.

While this is better news for HubSpot, it still confirms the point in the introduction of this article: Many folks have witnessed the impact of content surpluses firsthand through diminishing returns with increased time and resources spent on content and inbound marketing activities.

The Glory Years of Industry Content Deficits

As stated above, the timing for the implementation of inbound from Moz and HubSpot couldn’t have been better. Why? Because that was a time when digital marketing as an industry was in a state of online content deficits. Meaning, there were more people on the internet seeking solutions to their problems than there was content to solve them.

This meant that organic inbound visibility was much easier to gain last decade (even some of this decade, depending on the industry) than today. Most industries were experiencing content deficits, with few exceptions. Today, the opposite is true.

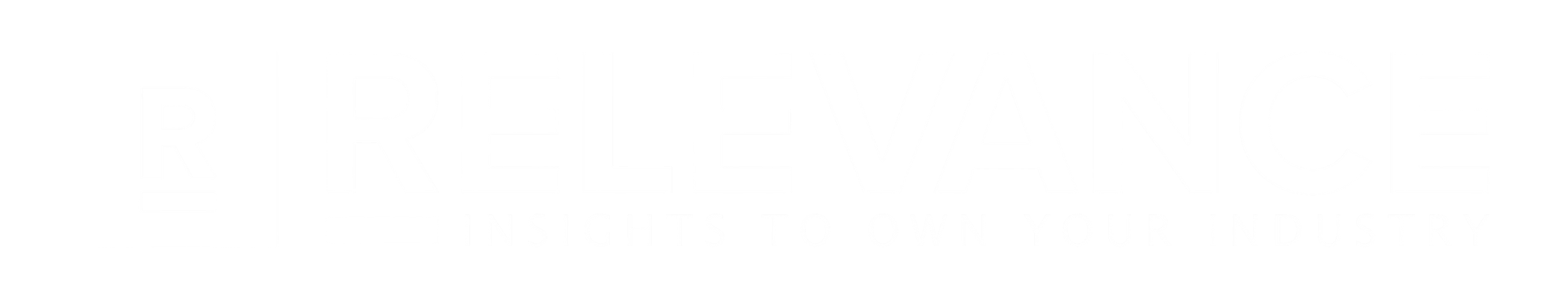

Here’s what that looks like graphically:

The above graphic shows organic inbound visibility plotted against an industry’s average domain authority and juxtaposed with content surpluses. Layered on top of that is the number of industries in the inbound success zone (content deficit zone) versus the number of industries in the inbound frustration zone (content surplus zone).

The X-axis represents organic visibility and the Y-axis bands represent average industry domain authority and content surpluses with 10 being the greatest. This is meant to give a general representation of the best and worst-case online scenarios for a company wishing to implement inbound or content marketing today.

Brands falling on the right side of the dotted line can likely focus exclusively on owned media (inbound marketing) without having to invest in PR or paid media. The further right a company is the less time, energy and resources will be required to gain visibility using only inbound or pull methods.

Content Surpluses Have Arrived for Most Industries

The ideal scenario for a company is having maximum domain authority with little to no content surplus within its industry. The worst-case scenario for a company is having minimal domain authority and maximum content surplus within its industry.

In this scenario marketers can’t just rely on inbound marketing, but must use earned and paid media, too. Thus, increasing the amount of time, energy, effort and budget required to gain the visibility necessary to be successful online.

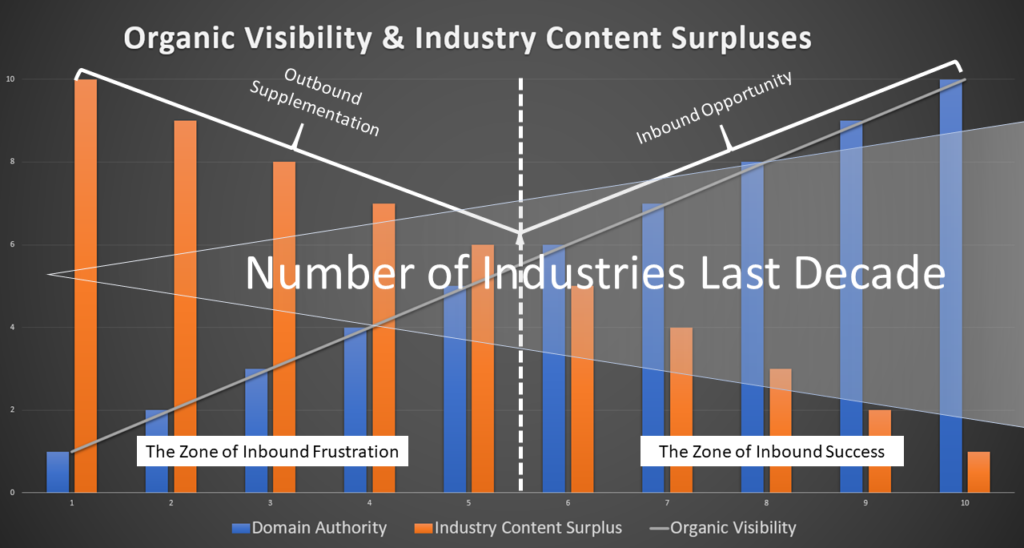

The image below shows where most industries fall this decade. It’s the complete opposite as last decade.

In this scenario it’s much more likely that a company’s industry is in a state of content surplus. This is where the amount of content on the internet for the industry exceeds the average domain authority for said industry. It also means that there is more content on the internet than people looking for that content to solve their problems.

The above triangle representation of what zone industries fall in is generous. If I were more skilled with PowerPoint the right side would have far fewer industries represented. Instead, the left side would be fatter.

Circling Back to HubSpot

The above explains HubSpot’s estimated increase in customer acquisition costs. It’s had to invest more across the board on owned, earned and paid media. In its early years, there was no content surplus for digital marketing and the average domain authority across the industry was low.

However, HubSpot quickly surpassed the domain authority of most every other website within the industry using inbound marketing last decade. Moz did the same thing. Both still reap massive benefits from this today, albeit with far more online competitors now. It’s also why HubSpot could keep customer acquisition costs lower than today.

What’s ironic is that HubSpot is partially to blame for this. Its inbound methodology has encouraged thousands of companies to add to their own industry’s content deficits until they became surpluses. Even without HubSpot, most industries would have moved towards content surpluses anyway. Just maybe not as fast.

The Solution

Industries come and go every day in this world. As a result, there will always be industries in a state of content deficit or surplus. Take a snail farmer for example. It’s likely that someone in that industry could duplicate the inbound methodology HubSpot perfected last decade today and see an enormous return on inbound effort without having to rely on earned or paid media.

However, for the rest of us, we must have a strategy that taps into owned, earned, and paid media – combining both inbound and outbound. Since most of the inbound marketing content is considered top-funnel, helpful, and “non-salesy,” our efforts should rely on those channels and methodologies that help drive visibility to said content.

Owned media (or inbound marketing) is today’s baseline for marketers wishing to gain success online. What HubSpot did last decade is merely the starting line today. Once the inbound (owned media) machine is up and running it must be supplemented with earned and paid media for content distribution.

The key today isn’t to rely on search engines and organic social media alone to drive visibility. The key is to tap into other online places with large prudent audiences and make them part of your audience.

Leveraging native advertising (outbound marketing) and all its channels (long-form, programmatic, non-programmatic, and paid social) is one-half of the solution. The second half of the solution is to tap the channels of earned media – influencer marketing, bylines, syndication, media outreach, etc. The content produced by inbound marketing will be used in paid and earned distribution.

Details on both earned and paid content promotion are featured in my books, “The Content Promotion Manifesto,” and “The Native Advertising Manifesto.” Both are free for download.