I spent the last several months conducting copious amounts of research in the areas of native ad tech and artificial intelligence which culminated into the publication of two free ebooks. The first, “Everything You Need to Know About Marketing Analytics and Artificial Intelligence,” was shared via email with the Relevance audience. The second rolls out what I uncovered cataloging the 2018 native advertising technology landscape – “The Global Guide to Native Advertising Technology 2018.”

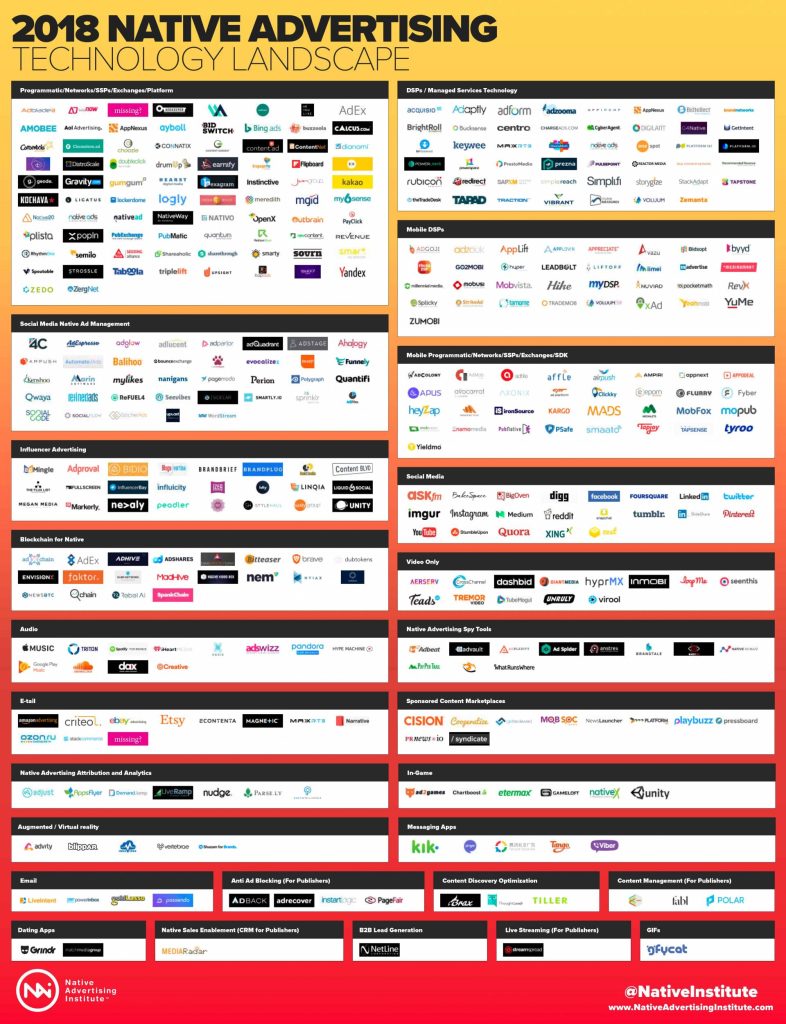

From 2017 to 2018 there was nearly 50% growth in the number of native ad tech vendors. It went from 272 to 402. Definitions and the methodology of the categories and the project at large can be found here.

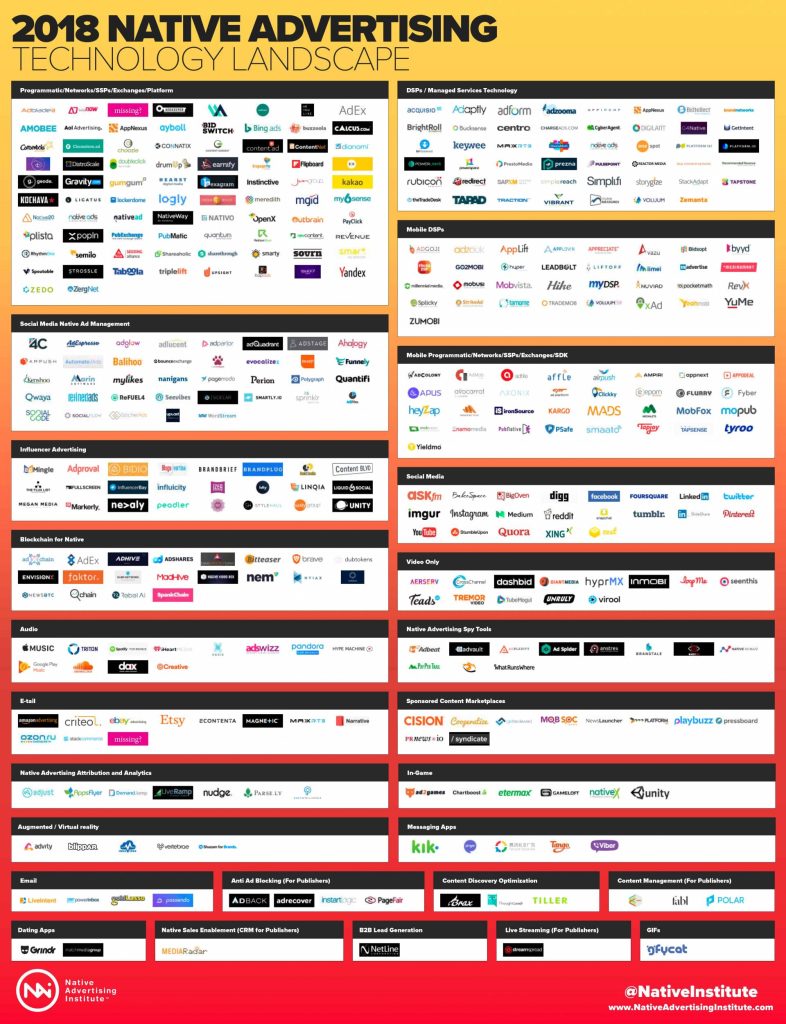

The 2018 Native Advertising Technology Landscape

Click on the landscape to view full screen

Download high-resolution versions

2018 Native Advertising Technology Landscape (1200 dpi JPEG)

2018 Native Advertising Technology Landscape (PDF)

Since we’re already in Q2, I thought I’d take a look at the growth of the native advertising technology landscape in just Q1 of this year. In the last three months, the landscape has grown by 48 vendors for a total of 450. That’s nearly a 12% increase since the beginning of 2018.

At that rate of growth, the 2019 vendor landscape will have annual growth of 48%, the exact growth from 2017 to 2018. It’s growing at the same speed in Q1 as in all of 2017. Now let’s explore the vendors that didn’t make the original 2018 native ad tech landscape and the categories they are in. Note: Just because these vendors didn’t make the original 2018 landscape doesn’t mean they didn’t exist in 2017. It just means I discovered them Q1 of 2018.

Programmatic/Networks/SSPs/Exchanges/Platforms

- Adiant – Native and non-native advertising units

- Adknowledge – Programmatic native and non-native advertising units

- Adzerk – Technology platform and APIs for buiding a native ad server

- Content Ignite – White label solution to take very own native platform to market. For publishers, advertisers and agencies

- DeepIntent – AI-driven native and non-native advertising units. Platform and exchange.

- Improve Digital – All-in-one advertising platform for publishers, content providers and broadcasters

- IndustryBrains – Premium native ad serving suite for publishers and advertisers

- OptiServe – Platform that facilitates the buying and selling of native and non-native inventory from Adiant

- RythmMax – Omni-channal exchange for RhythmOne

- Revenee – Programmatic native advertising SSP

- Solve Media – Native advertising through CAPTCHA

- Ströer – Programmatic ad server with both native and non-native capability – Germany, Austria, Switzerland

- Yieldlab – Premium native ad serving suite for publishers and advertisers – Native and non-native

Mobile Programmatic/Networks/SSPs/Exchanges/SDKs

- Apple News App – Native ad units in the Apple News app

- Cheetah Media Link – App monetization and customer acquisition using native units

- Glispa – Mobile only programmatic exchange, content discovery and playable creatives

- Madgic – Predictive programmatic mobile advertising technology. Connects supply and demand.

- Opera Media Works – Acquired by AdColony

- Pokkt – Mobile only exchange focused mostly on video and gaming

DSPs/Managed Services Technology

- BizzClick – A full-stack programmable advertising platform for native, display, mobile and video

- Maximus – Cross-platform native advertising campaign management

- Oath – Platform that taps into Gemini and BrightRoll

- SoMo Audience – A Self Service DSP created to help set up and run Internet advertising programs. Swipe thru technology.

Mobile DSP

- LiquidM – A mobile only self-service DSP

Video Only

- Biites – A video marketplace for connecting content, brands and publishers

- GothamAds – Video only SSP and DSP

Augmented/Virtual Reality

- io – Native ad units and formats with call-to-action and advanced interactivity features support across all major platforms and devices

Social Media

- ShareChat – India's fastest growing social network

Social Media Native Ad Management

- Connectio – Facebook advertising platform

Messaging Apps

- Facebook Messenger – In-feed sponsored content units

Attribution and Analytics

- Tune – Tracking and attribution for native, non-native advertising and marketing

Influencer Advertising

- Buzzanova – An influencer driven platform with paid distribution on networks and social media

- Crowdtap – Connects brands with micro-influencers. Pay using rewards - products or services. Gamified.

- Ad – Connects influencers and content creators with advertisers

Sponsored Content Marketplaces

- ContentDial (by Triplelift) – Programmatic-driven sponsored content marketplace

E-tail/Ecommerce

- Amplio – Amazon seller software with white-glove service teams

- Ecommerce Search Ad Insight (Kantar Media) – Competitive intelligence tool for monitoring sponsored ads on Amazon

- Sellics – It’s an Amazon PPC management software that tracks, analyzes and optimizes for performance

- Teikametrics – Software that optimizes sponsored product campaigns on Amazon

- Viral Launch – Amazon intelligence and seller platform for startups and enterprises

Blockchain for Native

- adToken – The token that powers adChain's technology

- ClearCoin – A technology company that powers the real-time buying and selling of media on decentralized applications and the broader digital environment

- DATx – Blockchain-powered digital advertising terminal to build native and non-native networks on

- IVEP – Blockchain-Based Cross-Platform and Cross-Network Protocol For Audio and Video Content

- Market – Connects bloggers and social media influencers with advertisers

- WildSpark – Blockchain driven content curation platform that connects creators and advertisers

In-Game

- HQ Trivia (Intermedia Labs) – Native advertising in a trivia game app

- Playtem – Native advertising in video games

According to ADYOULIKE, global native advertising spend will be $85.5 billion by 2020 and make up 30% of all advertising spending globally. Juxtaposing Q1’s numbers with all of numbers from last year make it clear that the native advertising technology landscape growth isn’t slowing down. The growth is consistent with the growth of last year’s numbers – in fact, it’s exactly the same. Entrepreneurs are jockeying for their piece of the native advertising investment growth.

For more details of the native advertising technology landscape visit the Native Advertising Institute. The free ebook download is also available there. The native advertising and artificial intelligence ebook is available here.

A variation of this article first appeared on Martech.Zone.